investing etc. 0006

My investment process, new ideas, Softcat, Dewhurst, RWS, performance watching, future of AI, the Swahili for giraffe, and a gratuitous picture.

How does an idea turn into an investment? My idea is that any company listed in London that has earned positive cash flow over the last three years is a candidate.

They turn into investments if I can’t find much to stop me investing in them.

Fault-finding our way to prosperity

Stage 1, is to look for problems in the numbers in SharePad. If there are only one or two problems and they are not show-stoppers, the shares join my research list. Four new ideas joined in January.

The fault finding continues, mainly using the annual report as a source. I calculate my own numbers, and I work out how the business makes money and what could stop it making more. If I cannot work out the business, either because it tells us too little, or the story I build up is incoherent, the idea fails at stage 2.

Softcat, an IT supplier, Dewhurst, which makes, distributes, and fits lift components, and translator RWS graduated from the process earlier this month, and my verdict was mostly positive. There was not much to worry about.

I work on the principle that if the risks are manageable, the returns will follow. Let us hope they do.

Finally, it was the beginning of the month not so long ago. That’s when we publish the Share Sleuth portfolio update. Share Sleuth is the product of my process, and this month I wrote about its performance, which is very rare.

In investing, where we direct our attention is everything. If we direct it at performance, two undesirable things happen. The first is that we’re spending time on that, when we should be analysing companies. The second is that we might be influenced by our performance.

To find out why that is a bad idea for buy and hold investors, you will have to read the article.

Turning to fiction to ponder AI

An unexpected hit

I usually have two books on the go at a time, a work of nonfiction in proper book form that sits on my desk and a novel in ebook form on my bedside table.

Currently I’m about halfway through The Globemakers (see Investing etc. 0005). If you like cartography, or start up-business stories, you’ll love The Globemakers because it is a charming tale of a startup globe maker mashed up with the story of globe making.

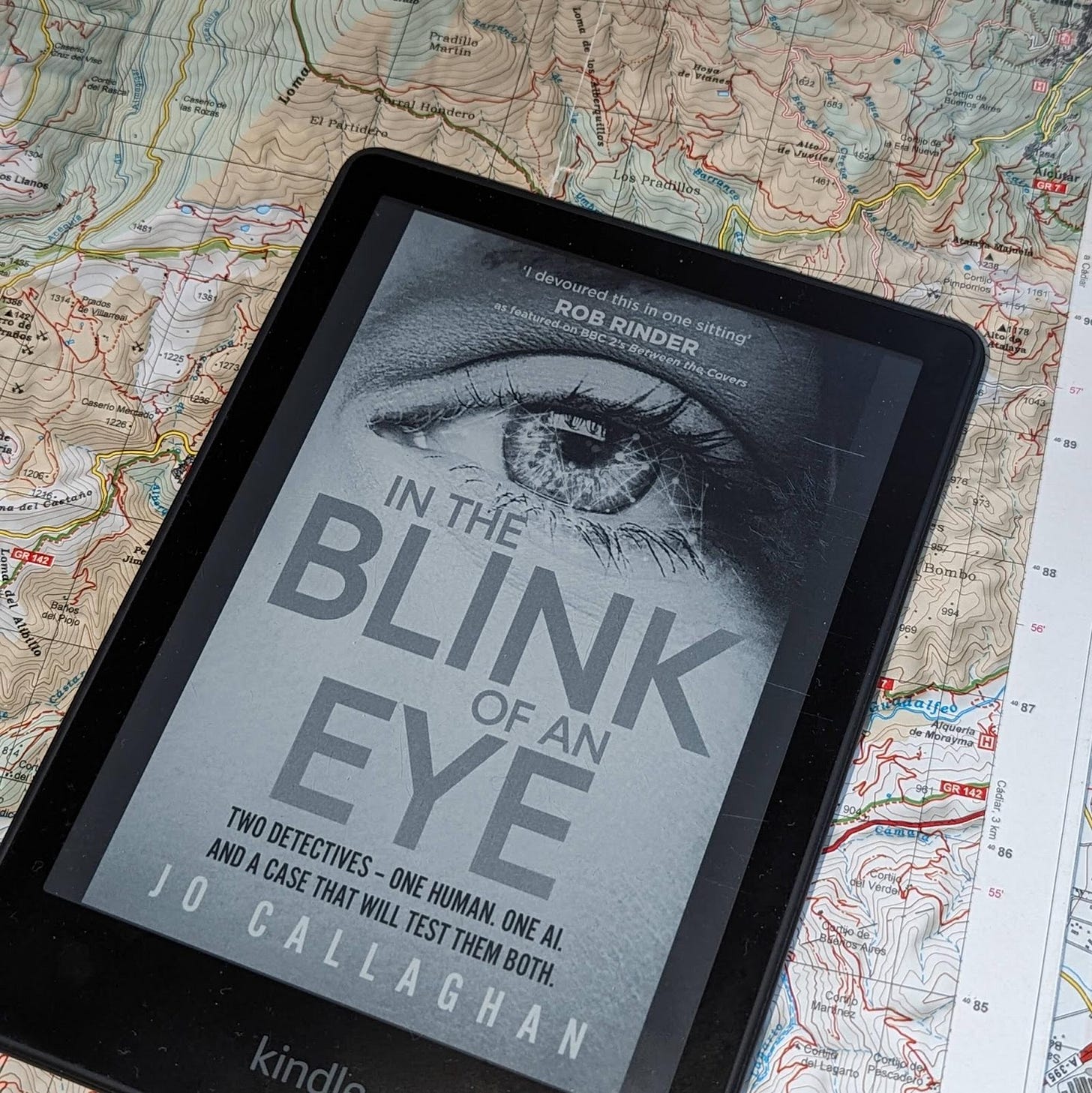

I finished the novel, In The Blink of an Eye by Jo Callaghan rather breathlessly in the early hours of Saturday morning.

It was a surprise hit because In The Blink of an Eye is a police procedural, and I can’t stand police procedurals!

The setting is indistinguishable from the present day, except the detectives are participating in a pilot scheme testing out a holographic police officer cast in the image of Chadwick Boseman. It is powered by artificial intelligence.

The AI angle was the sweetener for me, because we’re all trying to work out how we will work with AI. But to my surprise I was gripped by the serial killer aspect too. That may be because of the author’s direct experience of one of the other big themes, which I will not reveal.

I picked the book because of Brian Clegg's review, and I agree. It’s 5/5 from me too.

Thank you

Gratuitous photo of the fortnight: Students queue outside The Buttery, Cambridge University

Thanks for reading, if you have been with us since Investing etc. 0001, you may remember I support The Livingstone Tanzania Trust, recently featured in a double-page spread (see page 40 and 41) in no less august a publication than Twiga (Giraffe in Swahili), the inflight magazine of Air Tanzania.